Reflections on the Longevity Economy

The "longevity economy" is more than just a trend. Analysts estimate its value at as much as $27 trillion, and view it as a fundamental reshaping of society, work, and life itself. As we move beyond the linear "education, occupation, relaxation" model of life, societies all over the world need to engage with this change and its implications for their citizens. Longevity itself has many facets expressed in many different ways, but what does all of this mean in practice? Below is an exploration of four areas of life touched by longevity and the fundamental changes to well-established assumptions that must be made in order to address the needs of changing populations everywhere.

Protecting Your Assets: How to Recognize Financial Scams

Financial scams are increasing in both their reach and sophistication, and older adults are among the most frequent targets. Criminals prey on people’s trust and their desire to maintain financial security, and today it is critical to know how to spot fraudsters before they can do any damage. One of the keys to effective prevention is understanding and identifying the common ploys. Here are some examples of which you should be aware.

Four Emerging Financial Trends for Older Adults

From diversified income streams to technology-based financial planning tools, older adults are focusing on new strategies to ensure security in retirement. Rather than simply drawing down on their investments, many people are looking to build wealth well into their later years.

How to Avoid Scams and Fraud

Financial scams are a global industry. Keep you and your money safe with these tips from the National Council on Aging.

New York Times: Keeping a Mortgage After Age 65?

A New York Times article recently explored evolving financial strategies for older adults, and questioned the view that paying off a mortgage in retirement was the best move.

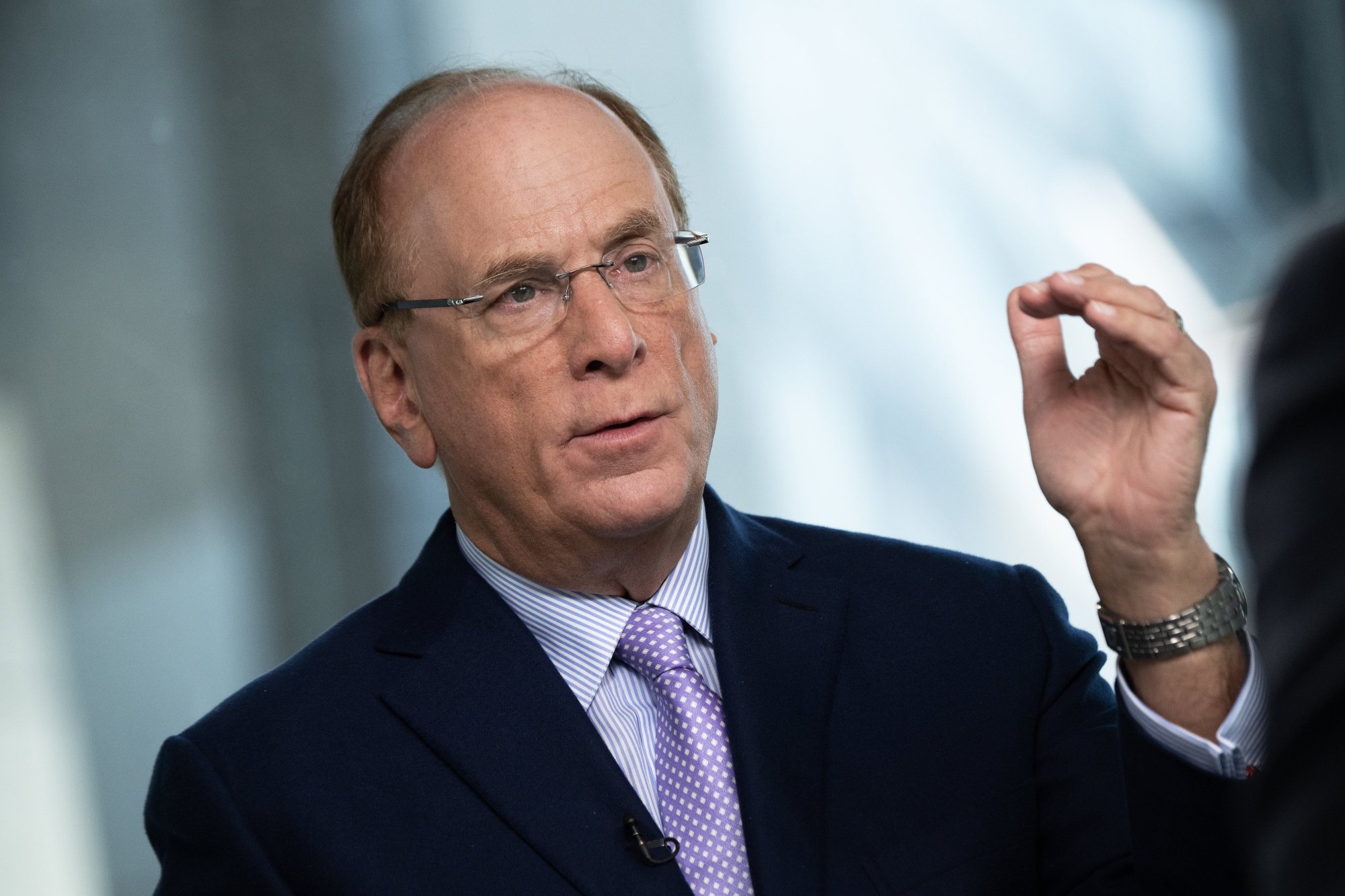

BlackRock CEO: “It’s Time to Rethink Retirement”

A response to BlackRock CEO Larry Fink’s annual letter to investors in which he said retirement as a concept needs to be reexamined to accommodate the changing needs of older adults.